AI-Driven Fraud Management and Compliance for Secure Visa Application Payments

Unlocking Peace of Mind: A Quick Dive Into Secure Payment Processing

Applying for a visa can feel like navigating a maze. Fees, forms, deadlines. One slip and your application stalls. That’s where secure payment processing becomes a game-changer. Imagine an AI agent that not only guides your Innovator Visa paperwork but wraps your fee payments in a shield of fraud protection and compliance checks. No more manual double-checks. No more worrying if your payment data is safely handled.

Torly.ai’s advanced AI reasoning models sit at the heart of this transformation. They monitor each transaction, spot suspicious patterns—biometrics, IP geolocation, you name it—and validate every step against the UK Home Office’s strict rules. It’s like having a 24/7 compliance auditor and fraud detective rolled into one. Ready to see how this elevates your application process? AI-Powered UK Innovator Visa Application Assistant for secure payment processing

Why Visa Fees Are a High-Risk Target

When thousands of visa applicants funnel payments, fraudsters circle. Here’s why:

- Centralised fee portals become a honeypot for credential theft.

- Inconsistent compliance checks invite chargebacks and delays.

- Generic fraud tools miss context-specific risks, like forged approval letters.

Traditional gateways like Cybersource tout hundreds of detectors—biometrics, IP checks, global coverage in 160+ countries. Their Decision Manager flags fraud across channels. Yet, they treat every payment as “one-size-fits-all.” A transit card payment has different rules from a visa fee. That gap leaves you vulnerable to unexpected declines or compliance hiccups.

How AI Elevates Fraud Management for Visa Payments

Real-Time Threat Detection

AI’s pattern-recognition excels where legacy systems struggle. Instead of static rules, Torly.ai’s agents learn:

- Normal payment flows for visa applications.

- Unusual behaviours, like repeated attempts from a risky IP.

- Outliers in payment card data.

These signals feed a dynamic fraud score instantly. You get higher approval rates and fewer false declines without sacrificing security.

Automated Compliance Validation

Visa fee payments demand your data align with Home Office mandates:

- Correct fee codes for Innovator Founder applications.

- Matching applicant references on every transaction.

- Proper receipts for proof uploads.

Instead of manually cross-referencing guidelines, AI scans each payment, flags mismatches, and prompts fixes before you hit “submit.” That ensures complete, compliant submissions and greater first-time approvals.

Global Coverage Meets Local Rules

Many payment platforms handle global commerce—with tokenisation, PCI DSS validation, 24/7 support. But they lack domain expertise. Torly.ai bridges that by:

- Layering visa-specific compliance atop global payment rails.

- Adapting in real time to rule changes from endorsing bodies.

- Proactively alerting you when governments revise fee structures.

This fusion of international reach and local nuance is key to truly secure payment processing in visa contexts.

Comparison: Generic Payment Platforms vs. Torly.ai

Strengths of Traditional Gateways

- Mature APIs and SDKs for developers.

- Broad support for cards, wallets, recurring billing.

- Proven fraud detectors across industries.

Limitations for Visa Applications

- No built-in checks for document references or fee codes.

- One-size-fits-all risk thresholds cause needless declines.

- No tailored action plans when compliance gaps appear.

How Torly.ai Fills the Gaps

- Pre-configured visa fee templates ensure you use correct codes.

- Adaptive risk scoring tuned to application workflows.

- Step-by-step guidance on remediating flagged issues.

In short, you get all the power of a global payments leader plus the laser focus of a compliance specialist.

Implementing Secure Payment Processing in Your Visa Journey

- Sign up on Torly.ai and link your payment gateway credentials.

- Select the Innovator Founder Visa fee template.

- Upload applicant data and fee schedules.

- Initiate payment—AI agents validate compliance in real time.

- Receive a fully compliant receipt and upload it to your application portal.

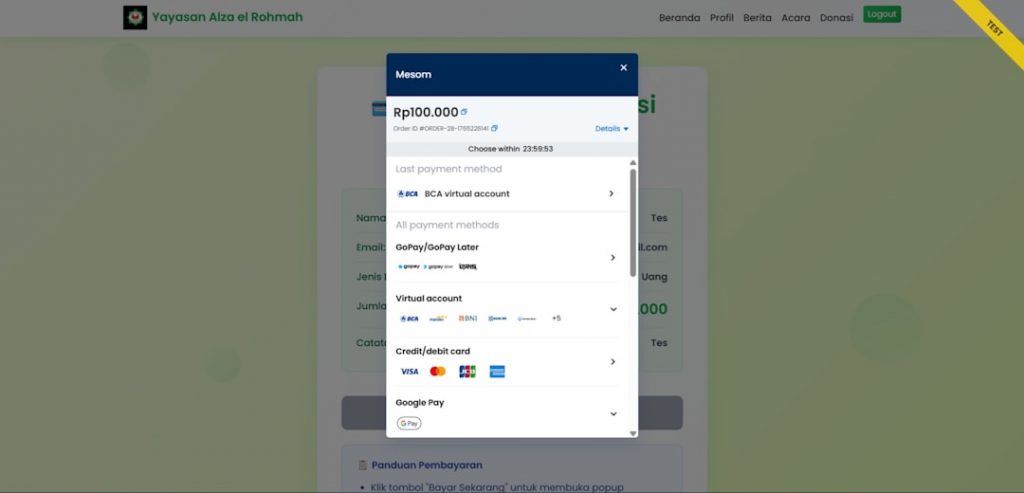

Along the way, visual dashboards highlight any anomalies. You can even set up automated reminders when fees or rates change. Need an extra layer of support? Developer-friendly APIs let you integrate these checks into your custom visa portal. Looking for more details on seamless fee management and fraud controls? Discover secure payment processing with our AI-driven assistant

A Hypothetical Scenario: From Worry to Approval

Meet Priya, an ambitious tech entrepreneur. She needs to pay her Innovator Visa fee while juggling market research and pitch decks. Using a standard gateway, she ran into an error: the payment failed because she entered the wrong fee code. Hours lost. Stress high.

With Torly.ai, the moment Priya typed in her applicant reference number, the AI flagged a mismatch. It suggested the correct fee code, auto-filled the details, and processed the payment through a secure channel. Priya got a clean receipt, uploaded it instantly, and breathed easy. That efficiency—powered by smart fraud detection and compliance validation—boosted her confidence and saved her precious time.

Real Voices: Testimonials

“Before Torly.ai, every payment was a nail-biter. Now I get clear prompts if anything’s off, and the AI catches fraud before it happens. My Innovator Visa fee process is bulletproof.”

— Arjun K., Startup Founder

“Torly.ai’s compliance checks are a lifesaver. I never second-guess the fee codes or receipt formatting. It just works, and my approval rates climbed to 95%.”

— Emily S., Tech Entrepreneur

“I love the real-time dashboards. I see exactly where fees get stuck and how to fix them. Payments take minutes, not days.”

— Mohamed A., Scale-up CEO

Next Steps: Secure Your Innovation

Securing your Innovator Visa shouldn’t be a rollercoaster. With Torly.ai’s AI-driven fraud management and compliance validation, you streamline every penny you pay. No more manual double-checks, no more surprise declines—just fast, secure payment processing aligned with UK Home Office rules. Ready to make visa fees one less thing to worry about? Get started with secure payment processing on Torly.ai